Cultured Meat Solutions

Support research and development of alternative proteins

Overview

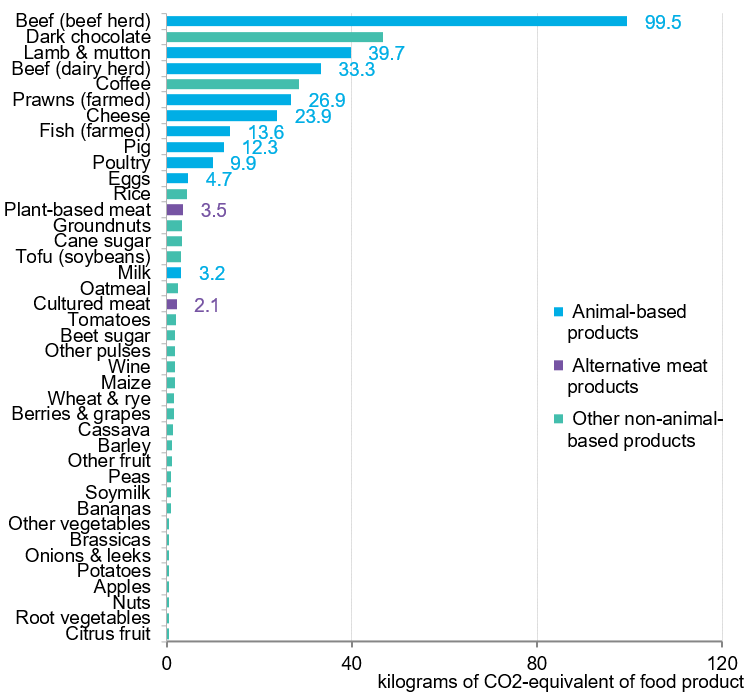

Given that around half of global agriculture emissions are from livestock, consumers’ dietary choice – more specifically demand for animal-based products – can have significant implications for countries’ decarbonization efforts. One option therefore is for governments to support research, development and deployment of alternative proteins such as cultured meat, which have significantly lower emissions than conventional meat products, as well as requiring less land and water.

Cultured meat – also known as cultivated, clean, lab-grown and in-vitro meat – uses the same engineering techniques found in regenerative medicine to grow, repair or replace damaged cells or tissue. As with plant-based meats, cultured meat is a direct substitute for regular animal meat. It does not result in the slaughter of livestock, provided fetal bovine serum is not used as a culture medium. Instead, cells are taken from a living animal and grown into meat outside the animal’s body.

Source: Alternative meat products – Good Food Institute. Ritchie, H. and Roser, M., Environmental Impacts of Food Production, 2020, accessed: August 2021.

Impact

There is a growing number of cultured meat labs, and examples of where it has been consumed in private spaces via demonstration projects, and at end-2020, the first cultured meat product was approved for sale by a regulatory authority. Cultured meat producers are targeting both ground and cut products. Indeed, it may be easier to culture meat cuts than to produce them from plants. However, this is an extremely complex and costly process. No company is close to achieving this consistently, let alone at scale.

In the simplest description, groups of animal cells known as cell lines are attached to a scaffold that organizes the pattern of growth. The cell lines are placed in a controlled chamber called a bioreactor, where they are fed a cocktail of nutrients known as growth medium or culture. In here, cells divide and grow to form small strands of muscle, fat, and connective tissue. The scaffolds are moved around, or ‘exercised’, to simulate the stress cells come under inside an animal’s body. This ‘exercise’ creates stronger muscle cells with a higher protein content. Strands of meat are then collected from the scaffold and run through a grinder to produce a familiar meat texture. Designing cultured meat cuts is possible, but far more complicated. 3D printing is being investigated as a way to produce more complex meat structures.

Cultivation costs have come down significantly since Mosa Meat unveiled the world’s first “slaughter-free” beef burger in 2013, costing $270,000. Future Meat Technologies was reported to have cut costs to $200 per pound ($441 per kilogram) for beef and $150/lb ($331/kg) for chicken. By comparison, it costs some $0.66/lb ($1.45/kg), to raise and slaughter a cow for meat. Future Meat Technologies aims to reach $10/lb ($22/kg) of cultured beef by 2022, and have raised $14 million to build pilot manufacturing facilities to test their processes at scale.

Opportunity

Cultured meat processes are expensive at a small scale, but in theory should be repeatable and scalable. Therefore, the industry should benefit from economies of scale and see cost reductions in line with manufacturing efficiencies, technology improvements, and shared learnings within the industry. Governments could therefore make a significant contribution to the growth of cultured meat by helping to fund research, development and demonstration into how to reduce costs. For example, competitions could be held to award grants and low-cost loans to projects on culture medium – the largest cost driver for lab-grown meat – as the industry has little potential to succeed until a low-cost solution is found. It was previously only used in the pharmaceutical industry, which has strict governance and requires full transparency and traceability of each ingredient used. This creates high costs. The meat industry may not need such stringent levels of verification, but the requirements remain uncertain in the absence of any regulation.

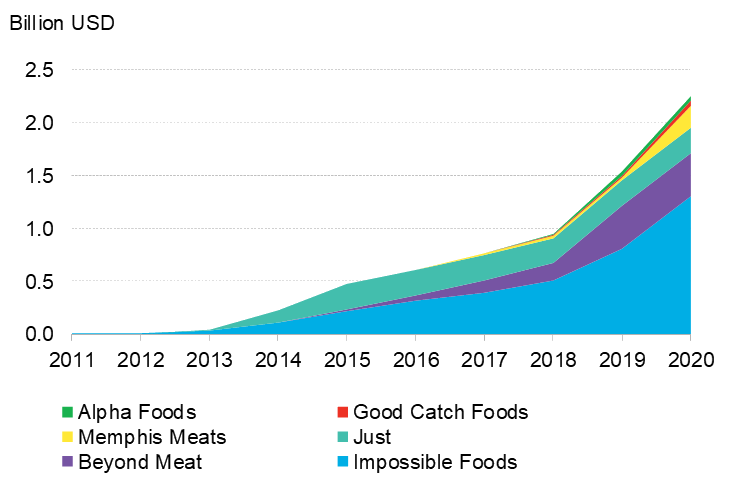

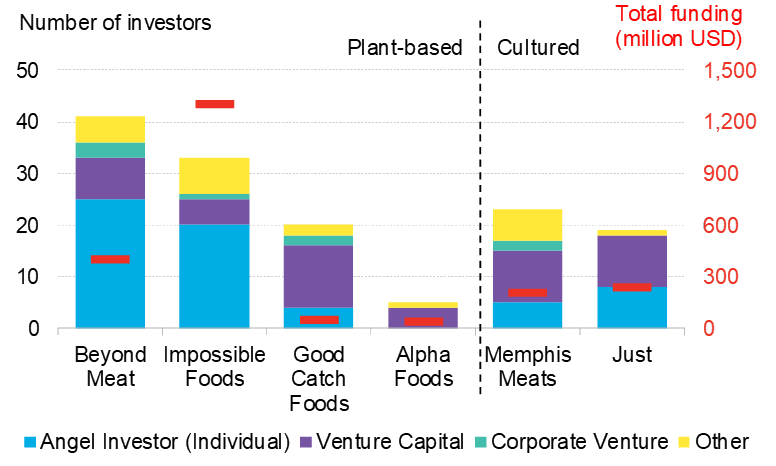

Hype around meat alternatives is seeing producers gain interest and investment from a diverse group of stakeholders. The six most funded alternative meat companies have received almost $2.5 billion in investment since 2011, 58% of which has gone to Impossible Foods. Angel and celebrity investors –including Sir Richard Branson, Serena Williams, Bill Gates, Jay-Z, and Jeff Bezos – make the largest cohort of funders, contributing 43% of the total investment. Venture capital funds account for the next largest investor group, followed by corporate ventures. These figures do not include corporate acquisitions.

Source: CB Insights, BloombergNEF. Note: includes companies with cumulative funding over $50 million. Includes only funding disclosed in the public domain, excluding corporate acquisitions.

Source: CB Insights, BloombergNEF. Note: includes only funding disclosed in the public domain, excluding corporate acquisitions.

Policy makers can also help by holding workshops and other events to promote knowledge sharing and creating partnerships with academic institutions and private-sector players. However, they would have to mitigate the high level of secrecy – where patents for proprietary technologies and techniques attract venture capital. Most cultured meat companies are vertically integrated, managing the entirety of their value chain. Nonetheless, a sector-wide trade body could be formed, to promote collaboration, devise a coordinate communications strategy, and encourage corporate commitments to transparency and traceability. Training programs could help fill the shortage of skilled workers in the sector.

A handful of cultured meat companies have reported that they are building pilot manufacturing facilities, joining Just and Mosa Meats, whose pilot lines are operational. And in December 2020 when U.S. startup Eat Just got the green light to sell its lab-grown chicken nuggets at a restaurant in Singapore. However, companies are unlikely to expand their pilot manufacturing facilities (and help to bring down costs) until the regulatory framework is in place elsewhere. Many of the ingredients used for growing cultured meat have yet to be reviewed and approved for food consumption in the vast majority of countries. This process can be long and expensive, and while industry players agree on the need to work together to overcome regulatory barriers, they are unlikely to be willing to share too many details on their products and processes.

Once regulation is in place, it will be important for policy makers to raise consumer acceptance of alternative proteins, highlighting their potential advantages relative to conventional products. Consumer attitudes and dietary patterns have been shown to change quickly, and there is precedent for foods to become acceptable after periods of rejection. Restaurants and other food-service companies will play an important role in driving trial and consumption of these products. Governments and public-sector institutions (eg, schools and hospitals) can also help to encourage consumers to try them.

Until deployment of cultured meat products reaches a scale that triggers cost declines, national and state-level policy makers may want to consider adjusting the price signals in their favor compared with animal products. In such cases, they should consider the impact on low-income households, as meat demand may be relatively inelastic to changes in price.

Source

Source: BloombergNEF. Extracted from Alternative Proteins: Fake It Till You Make It published on November 30, 2020 and from Lab-Grown Meat to Land on Singaporean Plates published on December 02, 2020. Learn more about BloombergNEF solutions or find out how to become a BloombergNEF client.