Incentives for Carbon Capture, Use and Storage: United States

Support development of carbon capture and storage (CCS)

Overview

Carbon capture, utilization and storage (CCUS) is the process of reducing a facility’s carbon emissions by separating, compressing and transporting the CO2 for use in industrial or drilling processes elsewhere or storage. It can also contribute to the ‘circular carbon economy’ by creating a second life for captured CO2 by ‘upcycling’ it into new products including concrete, nanotubes, chemicals or fuels. Some of these products are converted back into energy at the end of their life or decompose, potentially releasing the captured CO2 into the atmosphere. However, CO2 at stationary facilities can be captured again, creating a circular loop. Finally, CCUS can be used to produce low-carbon hydrogen from natural gas, coal or biomass and can even be applied to biomethane production sites.

Source: BloombergNEF.

Impact

While CCUS could in theory make a significant long-term contribution to decarbonization, the technology has not yet been deployed at scale. However, the industry is gaining momentum, not least due to countries’ and companies’ net-zero targets.

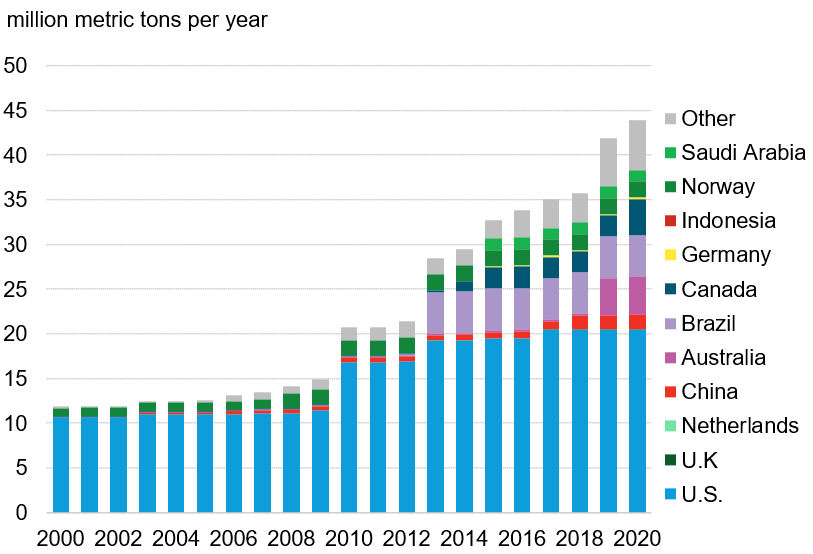

The market is especially concentrated, with the G-20 countries accounting for the lion’s share of operational capture capacity, especially the U.S. The dominance of North America has largely been due to the presence of natural gas processing plants, which have cheap costs for carbon capture and tend to be located close to demand sites – notably oil fields to use it for enhanced oil recovery (EOR). Other drivers have been the availability of geological storage, backing and expertise from the mature oil & gas sector, as well as government support.

If the current CCS project pipeline is fully developed to 2030, the U.S. would maintain its place as the leader in installed capacity, followed by the U.K., the Netherlands, and China. All three countries currently have less than 2Mtpa of capacity operating today.

Opportunity

Despite the fairly slow progress to date, carbon capture is experiencing rapid growth, with $3 billion of investment in 2020 and 33 commercial projects announced in 1H 2021. Governments’ and companies’ net-zero targets are one of the drivers of this activity. However, in order for CCUS to play a significant role as a decarbonization technology, the industry needs widespread adoption to bring down costs.

Policy makers have a crucial role to play by introducing incentives to spur deployment. For example, in the U.S., the federal government’s 45Q tax credit is the primary CCUS policy, offering $34.81 for projects storing the CO2 in dedicated storage sites and $22.68 for projects selling on the CO2 (for enhanced oil recovery, for example). Some states also offer support, such as California’s Low Carbon Fuel Standard. This approach enables project developers to stack national and subnational incentives, making some states much more favorable than others offering only the 45Q credit. Other policy makers have opted to provide financial incentives: for example, the Australian government awarded A$50 million ($38 million) to six CCUS projects.

Policy makers can also focus support on hard-to-abate sectors like cement and steel, and low-carbon hydrogen production, which should lead to considerable growth in the market. Carbon capture as a removal technology has also grown and direct air capture is likely to be needed to offset the last fraction of emissions from very-hard-to-decarbonize industries. For example, the U.K.’s plan for the technology is underpinned by industrial clusters, to reduce costs by sharing infrastructure and more efficiently decarbonizing areas responsible for a significant share of emissions. For example, in 2020, it announced up to 1 billion pounds ($1.3 billion) from its CCUS Infrastructure Fund to support two industrial clusters by the mid-2020s and four by 2030. Some of these projects were also awarded funding in March 2021 from the Industrial Strategy Challenge Fund. Several countries in Europe and Asia are taking a similar approach.

In addition, governments can also create market signals for CCUS by putting a price on emissions. Such policies – ranging from carbon taxes in Canada and South Africa to the cap-and-trade schemes in South Korea and the EU – have helped nearly triple CCUS capacity over the last decade. Alternatively, policies can create revenue for the utilization of captured carbon. Today, about 70% of the captured carbon is used for EOR, while another 20% is stored in geological formations like saline aquifers.

Another area that will likely require government support is to deploy the required transport and storage infrastructure. Storage infrastructure essentially serves as a CO2 offtaker, but does not generate revenue – instead, it usually comes at a cost making it less preferable to utilization. Only sufficiently high carbon prices could drive companies to choose this route for CO2 disposal. It also may represent an opportunity to reuse old natural gas infrastructure that is at the end of its life. A gas pipeline could be repurposed to transport CO2 instead of being decommissioned, depending on its design, condition and location.

The infrastructure for CO2 transportation and storage has been slow to develop, given uncertainties around both supply and demand. Government incentives focused specifically on this part of the supply chain are also lacking. That said, some countries are offering support across the whole CCS supply chain. Norway aims to realize a full-scale CCS value chain by 2024 through its ‘Langskip’ (‘Longship’) project. The CO2 transport and storage component – known as the Northern Lights – will be developed and operated by a joint venture comprising Equinor, Shell and Total. The capture of CO2 will be provided by Norcem’s cement plant and Fortum Oslo Varme’s waste incinerator. Gassnova is coordinating the overall effort. Langskip will cost more than 25 billion kroner ($2.9 billion), of which the state proposes to fund two-thirds.

Establishing a CO2 storage hub should enable nearby sites to avoid the cost of emissions by storing their CO2 instead. Developing a centralized network can save individual companies from bearing the costs of their own transport and storage and bring economies of scale. Open-access infrastructure is key to achieving low costs for CO2 transportation and storage. Establishing sites for CO2 injection requires extensive testing for geological properties and storage security, meaning one large network – rather than many smaller and independent ones – will be more economical. Pipelines too come with economies of scale, leading to lower transport costs.

Source

BloombergNEF. Extracted from G20 Zero Carbon Policy Scoreboard report, published on February 1, 2021. Learn more about BloombergNEF solutions or find out how to become a BloombergNEF client.

Read next

Related actions

Support carbon capture, utilization and storage projects and infrastructure and other carbon removal technologies

- Power and Grids

- Industry and Materials

- Companies

- Financials