Plant-Based Meat Solutions

Support research and development of alternative proteins

Overview

Plant-based meat refers to products that imitate and act as direct substitutes for animal meats – in terms of appearance, taste and texture – but do not contain animal proteins. Chicken, beef, pork and fish are the main plant-based meats available, though more niche products such as faux duck and turkey are also available. Traditional vegetarian alternatives such as bean burgers and tofu do not fall into this category because they do not share characteristics with animal meat.

The plant-based meat market was worth $939 million in 2019 in the U.S. alone, according to the Good Food Institute – an increase of 38% since 2017. A number of high-profile product launches, distribution partnerships, and initial public offerings have bolstered interest in the segment

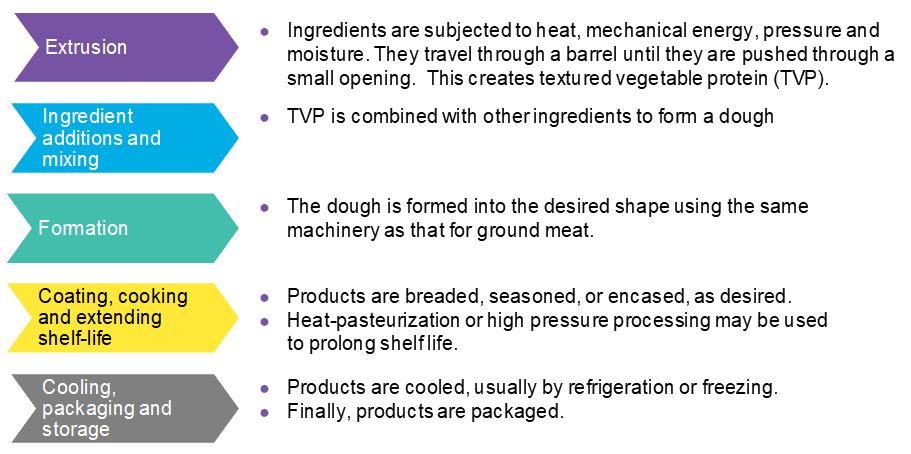

Plant-based meats are created using extrusion, which produces a protein texture that resembles highly processed or ground meat products, of which there are plenty of plant-based substitutes on the market. Extrusion is widely used in the food industry to create products such as cereal and pasta due to its low cost, product quality, versatility and productivity. As such, the plant-based meat industry is able to repurpose existing capital equipment, expertise, and supply chains within the food production sector.

Plant-based meat companies tend to manage the majority of their value chain, with the exception of the raw ingredients, which they purchase from a supplier. Isolated protein powder is one such ingredient that is typically purchased from a third party. In the case of peas, the outer shell is removed by mechanical action. A flour containing starches and proteins is obtained through milling. Pea protein is water soluble, allowing it to be removed by adding water to the flour. It is isolated and collected when it reaches its isoelectric point.

Source: Good Food Institute, BloombergNEF. Note: Extrusion may also be used to make cuts of plant-based meat. In this case, there is more focus on marinating the dough in fats, flavors and functional additives for texture.

After extrusion, the textured vegetable protein (TVP) is mixed with other ingredients to form a dough. The dough can consist of a mixture of proteins, fats, carbohydrates, vitamins, minerals, spices, concentrated additives, as well as additives derived from plants or fungi to improve texture and consistency. The dough is then formed into shape, and breaded, seasoned or encased, depending on the desired product. The same machinery as used in the meat industry can be used for this. Products are cooked if required. Finally, products are cooled and packaged.

Impact

Meat from livestock has higher protein content than any of the plant-based alternatives examined with the exception of plant-based sausage (versus pork). The plant-based substitutes also tend to contain more fat than animal meats, though less saturated fat. The health credentials of plant-based meats are poorly understood by the consumer and may become a barrier to widespread adoption. However, several producers strive to improve the nutritional contents of their plant-based meats.

Source: BloombergNEF. Note: Green cells indicate the lower value, except for protein. Analysis compares: a) Impossible Burger to Tesco’s Finest Burger, b) Beyond sausage to Heck pork sausage, c) Raised &Rooted chicken nuggets to Birdseye nuggets ,and d) Good Catch Foods tuna to John West tuna.

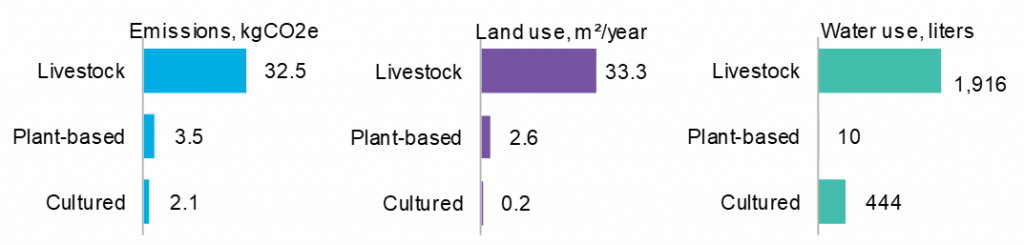

But alternative meat performs significantly better than meat from livestock in three key environmental areas: emissions, land use and water use.

Source: Good Food Institute, BloombergNEF.

Opportunity

Half of the top 10 plant-based meat companies (in terms of dollar sales) rely on pea protein to make their products. Soy is the next most popular, followed by mycoprotein from fungi. Soy is more prevalent as an ingredient among start-ups, with almost 60% of companies examined citing it as a key ingredient. This may be due to the low cost of soy. Start-ups are less likely to be able to negotiate pea prices while operating at small scale. Pea protein isolate ranges from $4,200 to $4,600 per metric ton, compared to soy bean protein isolate at around $3,500 per metric ton.

Soy was an early leader in the plant-based protein space. It is a commodity crop with multiple existing uses including animal feed, food products, and biofuels. It is readily available at low prices. However, there is some anti-soy sentiment among consumers due to concerns over genetic modification and health.

The number of pea protein-based food and beverage products launched between 2016 and 2018 grew by 19% each year. Demand has increased to the point where supply has suffered from shortages. Producers have since announced additional capacity. Cargill invested over $100 million into pea protein supplier Puris, allowing it to build a further two facilities in North America. Another supplier, Roquette, is investing more than half a billion euros over the next five years to expand their current facility, based in France, as well as constructing a new site in Canada – set to be the world’s largest pea protein facility. Roquette supplied Beyond Meat with pea protein for about a decade.

Pea performs better than soy in terms of land use and water consumption, though soy requires slightly less energy than peas per kg of protein. Starch accounts for 60% of pea volume, but is not used in protein-based products. Finding a use for the starch will ensure long-term economic feasibility for the ingredient.

Vendors continue to search for alternative feedstock. For example, Beyond Meat mainly uses pea protein, but has said it will continue to diversify its products and hope to offer a range of plant-based protein sources. Impossible Foods has swapped protein source, from pea to soy. But as the ingredients behave differently, it is not simply a case of substitution. Rather, recipes and processes must be tweaked.

In terms of production costs, plant-based meat is currently priced at a premium to regular meats. However, costs are expected to decrease as the industry matures. Reasons for the current premium include:

With scale, plant-based proteins could cost less to produce than animal meats, as the cost of growing and processing soy or other feedstock should in theory undercut the cost of rearing and butchering livestock. This is because fewer inputs such as land and water are required, fewer crops are consumed because the metabolic cycle of converting plant-matter to muscle is bypassed, and production timelines are shortened. However, competition would likely need to increase significantly in order for those cost reductions to translate to retail pricing that undercuts animal meat.

Source

Source: BloombergNEF. Extracted from Alternative Proteins: Fake It Till You Make It published on November 30, 2020. Learn more about BloombergNEF solutions or find out how to become a BloombergNEF client.

Read next

Related actions

Promote dietary shifts to low-emissions sources of protein

- Agriculture

- Companies

- Consumers