Recycled Content Mandates: United Kingdom

Introduce circular economy requirements for producers and consumers of emissions-intensive materials

Overview

Recycled content mandates are the most advanced form of circular economy policy, and usually the last measure to be passed. These measures require that certain products contain a specified amount of recycled material. In some cases, legislation goes further, and requires this to be post-consumer recycled material, as in the case of the Break Free From Plastic Pollution Act, which was introduced into the U.S. Congress in 2020. Alternatively, governments can enforce these content mandates in the form of a tax on any product that does not meet the standard.

Impact

Under the U.K.’s Plastic Packaging Tax, for example, any plastic bottle sold from April 2022 that does not contain at least 30% recycled plastic will be charged 200 pounds ($260) per metric ton. The government expects this tax to generate between 220 and 240 million pounds ($282-308 million) per year over 2022-2025. In 2020, California’s legislature passed a bill requiring 50% post-consumer recycled content in plastic beverage bottles by 2030.

The EU has similar mandates, but they are in the form of targets and do not come with a financial penalty. The region is aiming for PET bottles to contain 25% recycled content by 2025, and 30% recycled content in all bottles by 2030.

In contrast, governments in East Asia are more interested in promoting sustainable material substitutes such as bioplastics. Japan has a target for bio-based plastics consumption to reach two million metric tons by 2030. However, South and Southeast Asian countries are following the European route. Indonesia, the world’s second-largest source of ocean plastic behind China, is planning to scale its recycling capacity. In addition, the government of Maharashtra, India’s second-most populous state, announced that industrial packaging produced in the state must include at least 20% recycled material.

Opportunity

Recycled content mandates can be particularly effective in encouraging circularity as they mobilize the entire supply chain. Packaging producers are required to source recycled material, generating demand and increasing prices for secondary materials. Higher prices incentivize waste managers to increase collections, and spur sorters and recyclers to improve their technology to generate a higher-quality recycled material. If the mandates are accompanied by an EPR scheme or financial penalty, these funds can also be invested in recycling infrastructure to bolster the supply chain.

The EU, for example, likely chose the values of 25% and 30% because they represent the amount of recycled PET that can be incorporated into bottles without altering performance or appearance, and without significant changes to existing recycling processes or output quality. In most mechanically recycled PET, there are small amounts of other materials or colored plastic that contaminate the resin. In order to increase the recycled content beyond 30%, packaging producers would have to use chemically recycled resin, or find a supplier that can more effectively sort the scrap feedstock to ensure it only contains clear, bottle-grade PET. Both options will require significant new capacity, either in chemical recycling plants or in advanced sorting technologies.

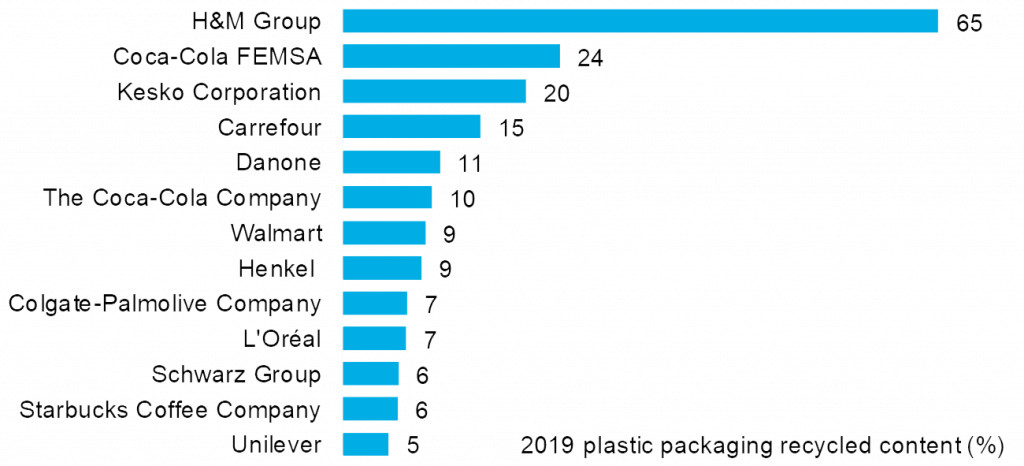

However, most companies have not achieved this level of recycled content in their packaging. The majority of large consumer-goods players use less than 10% recycled plastic in their packaging, according to a report from the Ellen MacArthur Foundation. These figures represent recycled content across all plastic packaging, and the values for only PET bottles would most likely be much higher. Nonetheless, reaching 30% recycled content globally will be a challenge for most companies and countries.

* Source: Ellen MacArthur Foundation, BloombergNEF. Note: Recycled content includes pre- and post-consumer recycled content. Companies included all have annual revenues over $10 billion.

* Source: Ellen MacArthur Foundation, BloombergNEF. Note: Recycled content includes pre- and post-consumer recycled content. Companies included all have annual revenues over $10 billion.

Source

BloombergNEF. Extracted from G20 Policy Scoreboard report published on February 1, 2021. Learn more about BloombergNEF solutions or find out how to become a BloombergNEF client.

Read next

Related actions

Introduce circular economy requirements for producers and consumers of emissions-intensive materials

- Industry and Materials

- Consumers

- Companies