Regulations on Single-Use Plastics: Japan

Speed use of bioplastics in consumer and business products

Overview

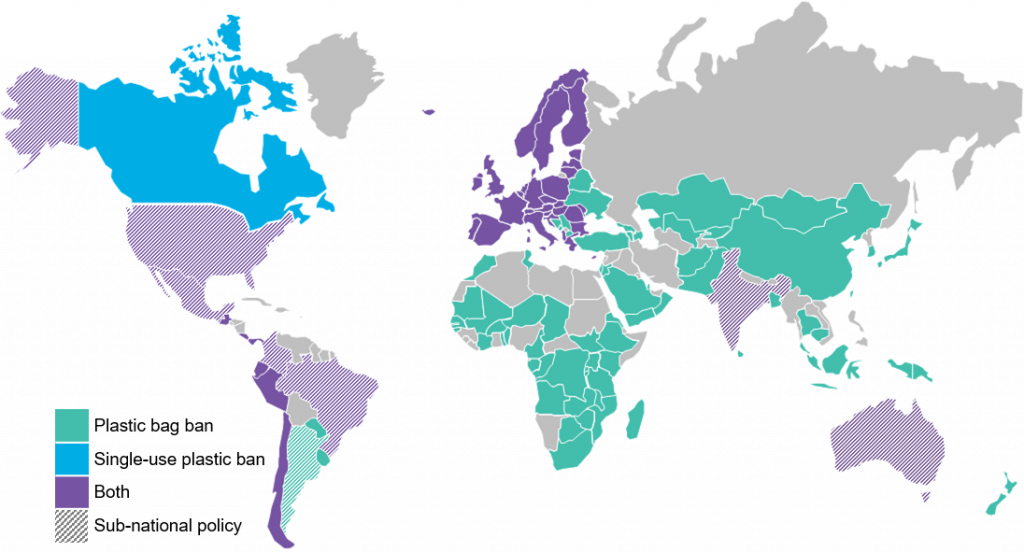

A growing number of governments at international, national and regional level have begun to crack down on single-use plastics. Used once or for a short period of time and then thrown away, these plastic products are a significant contributor to waste, especially marine litter, even though cost-effective, sustainable alternatives may be available.

Japan, for example, introduced its first single-use legislation in July 2020: retailers must now charge for plastic shopping bags. They can decide on the fee but it must be over 1 yen ($0.01). Exemptions apply to plastic bags thicker than 0.05cm, which are defined as reusable; 100% biodegradable bags; or bags made from materials with bio-based content greater than 25%. Bio-content must be certified with `biomass marks’ from the Japan Bioplastics Association or the Japan Organic Resources Association. The minimum bio-content will increase gradually over time. The government also set guidelines on how collected revenue should be used, such as investment in sustainable packaging or donation to the local government for environment protection projects. Japan consumes the second highest amount of plastics per capita in the world and lags behind other developed countries that have already taken multiple steps to ban single-use plastics.

Impact

In Japan, retailers had varying responses to the announced scheme. Almost all supermarkets, convenience stores and department stores have set a fee in the range of 3-10 yen ($0.03-0.1). Companies are often taking the policy a step further, providing bioplastic and paper bags as well as traditional plastic, while still maintaining the charge on these exempted products to encourage consumers to reduce all waste.

Chain restaurants such as Yoshinoya, KFC, McDonalds, and Kura Sushi are taking a different route, by providing bioplastic alternatives for take-out orders at no charge. These companies are primarily concerned about maintaining low prices for their customers, and ensuring their products are packaged and handled hygienically. To retain their reputation as cheap and convenient, these companies are bearing the increased cost of bioplastic bags, which are twice the price of normal plastic bags. Book, clothing, and other home goods stores are simply choosing to replace bags with small labels added to products at the cashier to confirm they have been paid for.

Opportunity

Single-use shopping bags consume approximately 200,000 metric tons of plastics every year in Japan. But these account for only 2% of all plastic waste, and 5% of packaging waste, meaning charges or even bans are unlikely to have a significant impact on plastic consumption or waste reduction. Nevertheless, these policies are a common first step in creating a wider circular economy strategy. The government also sees the policy as a way to increase public awareness of plastic waste and spur businesses to improve their material sustainability. Currently, 30% of customers refuse plastic bags when they shop.

Some countries such as the U.K. have seen success with charging schemes on single-use plastic bags, while others have switched to an outright ban instead. For example, South Korea has a ban on plastic bags in major supermarkets and bakeries, with a 3 million won (c.$2,600) fine. Such policies are more likely to be implemented by states, provinces or municipalities in the U.S. and Mexico.

Taiwan has one of the most elaborate single-use plastic strategies, which began with a ban on certain dining outlets (eg, chain restaurants and schools) giving straws to customers in 2019, which was extended to all dining outlets from 2020. Also that year, the government imposed charges on retailers providing free plastic bags, disposable food and drink containers and utensils. Eventually a blanket ban of single-use bags, utensils, straws and containers will be implemented by 2030.

Source: BloombergNEF

In addition to the charging scheme, the Japanese government sought to support the private sector in developing plastic recycling and alternative material technologies as an important element of the national circular strategy. New guidelines were drafted recommending that companies disclose information on plastic waste generation and reduction targets, as well as plans for sustainable materials adoption. Japanese companies were already required by law to disclose their business-related emissions. This new guideline had the potential to have a significant impact on companies that use large amounts of raw plastics materials and products, such as the fast-moving consumer goods industry. Japanese companies tend to comply with government recommendations even before they become law and some first-movers sought to get ahead by setting sustainable strategies and circular economy pledges, to pre-empt the requirement.

In Taiwan, the Environment Protection Agency has sought to collaborate with businesses by incentivizing them to encourage customers to switch away from plastic utensils (eg, discounts if they bring their own or tax rebate if they return plastic bottles), and to sort their waste. It has also worked with local governments to promote reuse of plastic bags and pilot rental programs for reusable drink containers.

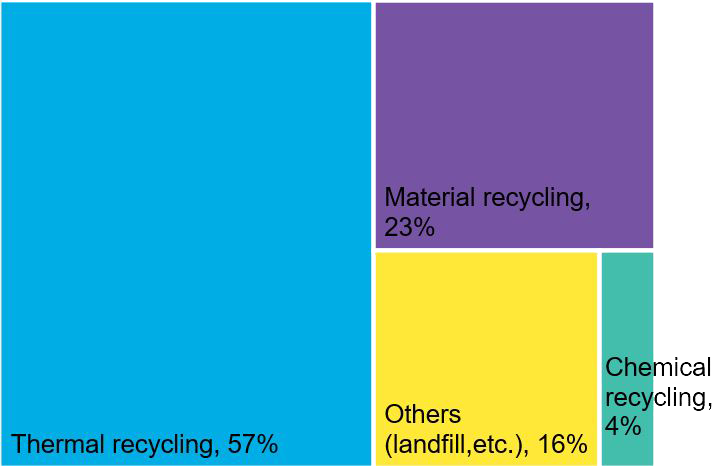

Regulations on single-use plastics like the charging scheme in Japan will also create demand for recycling capacity and sustainable materials. The country has a reported recycling rate of 84% for plastic waste. But 57% is incinerated for energy recovery – a route that is not considered circular in the strictest definition. Of the 23% of waste reportedly recycled back into materials, 14% is exported. The volume of plastics recovered mechanically and chemically within Japan only accounts for 13%..

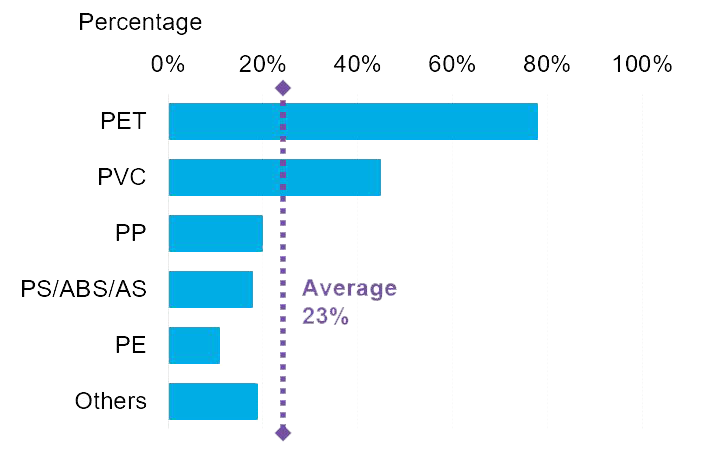

With increasing numbers of countries rejecting plastic waste imports and the Japanese energy and industry ministry’s target to double the material recycling rate, the nation will need to expand its domestic material recycling capability fivefold to 4.1 million tons per year by 2030. Among all plastics, circularity will be more difficult for Japan to achieve for polyethylene (PE), polypropylene (PP), and styrene compounds (PS/ABS/AS) since polyethylene terephthalate (PET) and polyvinyl chloride (PVC) have a relatively high recycling rate. The government announced in May 2021 that it would offer up to 40 million yen (c.$364,000) to recycling projects over the next three years.

Source: BloombergNEF, MOE, Japan Plastics Recycling Association. Note: Thermal recycling refers to incineration for energy recovery.

Source: BloombergNEF, Japan Plastics Recycling Association Note: The recycled amount includes those exported outside Japan.

Increasing policy support and public awareness of the circular economy will push the packaging supply chain to adopt more sustainable materials and practices. Demand for bioplastics and paper-based packaging are expected to rise in the next decade. Paper materials and products manufacturers in Japan already view this as an opportunity to save their shrinking businesses. They are actively developing new products that are able to replace plastic packaging for a wider range of products in order to broaden their market share.

Japan is also expecting a bioplastics boom. Global bioplastics production capacity reached 2.27 million metric tons in 2017, with Japan only producing 39,500 metric tons in the same year. This 1.74% share of production is disproportionate to the country’s leading position in the global advanced material industry in general. To meet the government’s target, Japan’s bioplastics demand will need to reach 500,000 metric tons if the bio-based content requirement stays at 25% by 2030. This is a 12-fold increase in 10 years.

Source

BloombergNEF. Extracted from To Be Circular Or Not, That Is The Question For Japan insight published on July 1, 2020. Learn more about BloombergNEF solutions or find out how to become a BloombergNEF client.

Read next

Related actions

Introduce circular economy requirements for producers and consumers of emissions-intensive materials

- Industry and Materials

- Consumers

- Companies