Round-the-Clock Renewable Energy Auctions: India

Accelerate build- out of current energy storage technologies

Overview

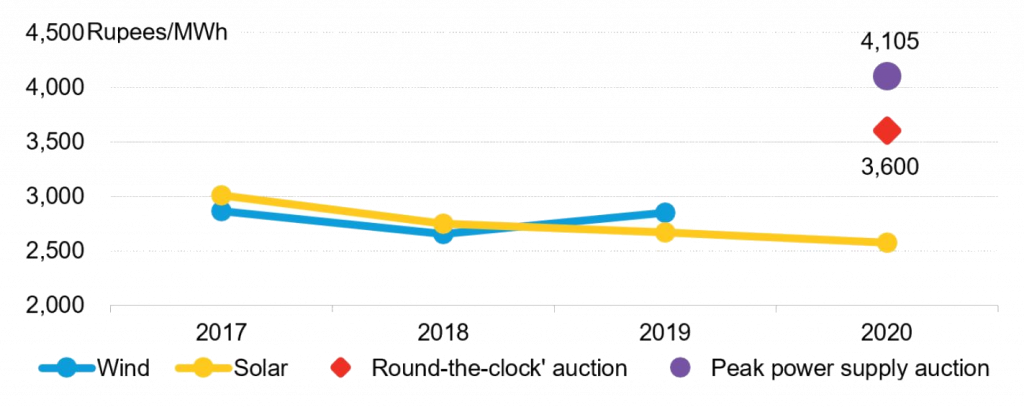

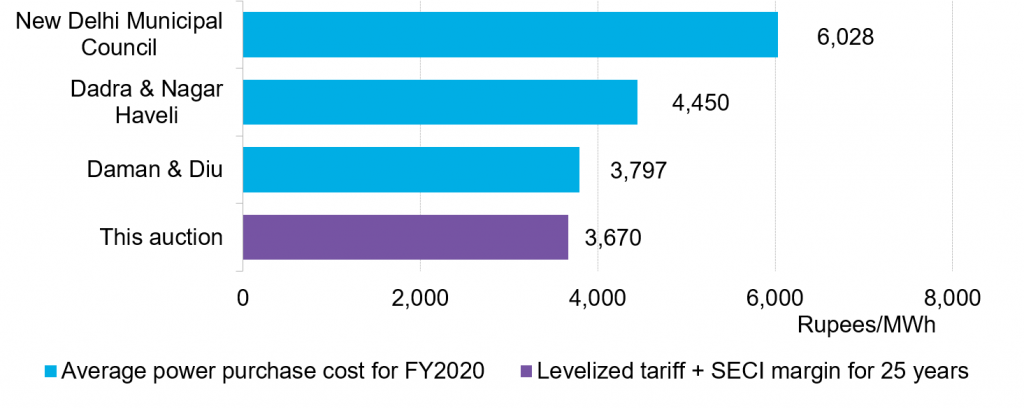

India completed its first competitive auction for ‘round-the-clock’ renewable power on May 8, 2020, with the winning project to use a mix of wind, solar and energy storage. With the tariff lower than the power offtakers’ average cost of electricity purchase, it lowers the attractiveness of coal power.

Renew Power (backed by Goldman Sachs) emerged as the winner in Solar Energy Corp. of India’s auction for 400MW of ‘round-the-clock’ (RTC) renewables. The resulting first-year tariff was 2,900 rupees ($38.85)/MWh, which rises 3% every year for 15 years and then remains constant for the next 10 years. Greenko Energies, HES Infra and Ayana Renewables were the other bidders in this auction where submitted bids totaled 950MW. The project can use a combination of any renewable power and energy storage technologies, although the latter is not mandatory. We expect the project to be oversized and be spread across multiple sites to meet the required 80% annual capacity factor. The choice of long- or short-term storage and its size will depend on the generation profiles at chosen sites and ReNew’s assessment of additional capex versus penalty for shortfall in power output.

The electricity distribution companies – the key offtakers – are pushing for these newer types of tender that match their demand profiles more closely and shift the responsibility of balancing intermittent renewables onto the independent power producers (IPPs). They will continue to remain price sensitive and will not accept tariffs higher than their current cost of power purchase. Top IPPs are taking the lead to develop the newer types of renewable projects in order to distinguish themselves from competitors. ReNew has won auctions for peak power renewables, floating solar and now RTC renewables. As a result it is gaining early experience of developing such challenging projects and will benefit if such tenders become mainstream.

Source: BloombergNEF, news reports. Note: For the ‘round-the-clock’ auction, the levelized tariff is calculated assuming a discount rate of 9%. This tariff is now comparable to other Indian auctions where the rupees/MWh remain constant in nominal terms for 25 years.

Impact

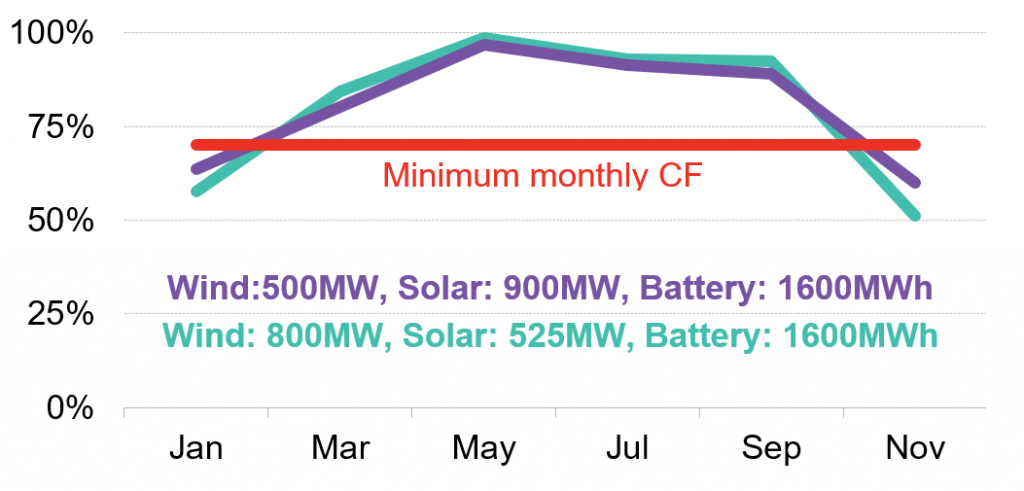

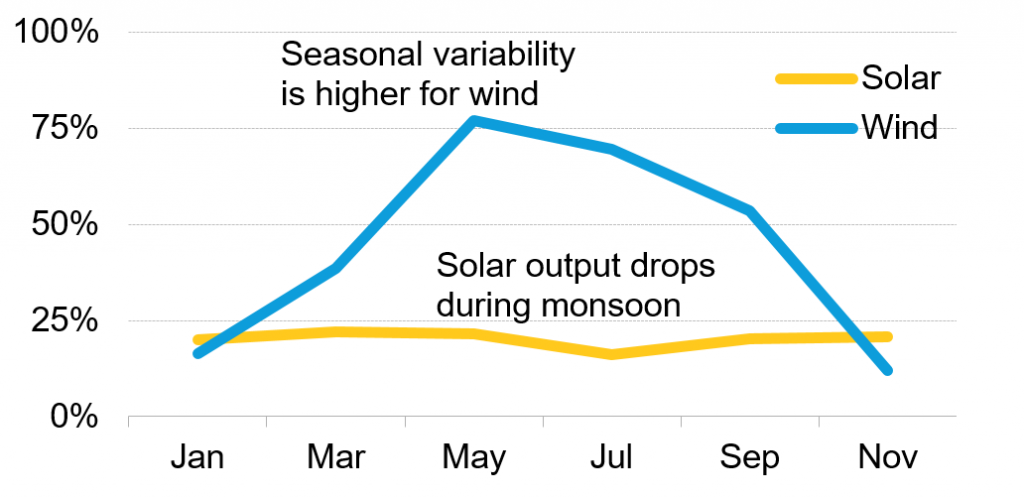

Oversizing of wind and solar capacity will be needed to meet the capacity utilization factor (CUF) requirements. The minimum annual CUF is 80% while each month’s minimum is 70%. CUF is the ratio of actual electricity output to the maximum possible output over a given time period. It may not be possible to achieve monthly CUF requirements even if the project is oversized by three times the rated grid-connected capacity, based on calculations at a representative location. This is because wind CUFs are generally low from November to January. Solar output shows less seasonal variability but its monthly CUF does not exceed 25%.

Source: BloombergNEF, tender documents. Note: The modeling is done using the Wind Capacity Factor Tool and Solar Capacity Factor Tool for a site in Kutch, Gujarat based on high resource availability. The solar capacities are in DC. Both configurations of wind, solar and storage are able to achieve the minimum annual capacity factor requirement of 80%.

Source: BloombergNEF, tender documents. Note: The modeling is done using the Wind Capacity Factor Tool and Solar Capacity Factor Tool for a site in Kutch, Gujarat based on high resource availability. The solar capacities are in DC. Both configurations of wind, solar and storage are able to achieve the minimum annual capacity factor requirement of 80%.

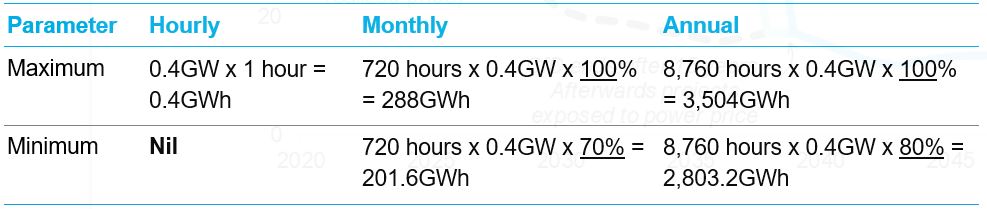

The tender terms do not put any restriction on the extent of oversizing. However, the project’s output to the grid is constrained by the grid connection size of 400MW(AC). At 100% utilization the project will be allowed to inject up to 3,504GWh annually. ReNew has the option to not dispatch power every hour in a 24-hour period as long as it meets the monthly and annual CUF requirements.

Source: BloombergNEF, tender documents. Note: Assumes standard month of 30 days and 365 days in the year. Capacity utilization factor needs to be at least 70% monthly and 80% on annual basis. The grid connection is 400MW(AC).

During the reverse auction process, the final tariff was 19% lower than the opening bid. This indicates that bidding was aggressive and that the IPPs were willing to use a toolbox of different financial and project configuration strategies.

The levelized tariff of 3,600 rupees ($47.65)/MWh is lower than the existing power procurement costs for the offtakers – the New Delhi Municipal Council, territories of Daman & Diu and Dadra & Nagar Haveli. We do not expect long delays in signing the power sale agreement with these offtakers as they have been clearly identified from the start. If we assume a discounting rate of 10.5% instead of 9%, the levelized tariff becomes even more attractive at 3,560 rupees ($47.12)/MWh.

Source: BloombergNEF, Delhi Electricity Regulatory Commission, Joint Electricity Regulatory Commission for the state of Goa and Union Territories, tender documents. Note: FY2020 is financial year April 2019 – March 2020. SECI’s trading margin is 70 rupees /MWh. Discount rate of 9% is used to levelized tariff of this auction.

The offtakers will still need to purchase power from their contracted thermal power plants or the power exchange to meet their remaining power needs. In the original tender, the buyer had the choice of not accepting the IPPs daily power output if it did not match the daily demand pattern. However, the Solar Energy Corporation of India later acknowledged that since renewables are accorded ‘must-run’ status and there is no control over the generation, the offtaker must procure all power as scheduled by the IPP, with the only exception being curtailment for ensuring grid security. The offtakers may call for more tenders for firm renewables as the tariffs help them lower their average power procurement cost. This threatens the future of the coal fleet.

Stand-alone wind and solar auctions have been the norm for renewables in India. The technology is defined clearly in the tender but there are no requirements to supply power within specified hours of the day. Renewables have priority dispatch and hence there has been no need for them to regulate power generation. The responsibility of balancing the intermittency of renewable output was left to the grid operators and the offtaker electricity distribution companies (discoms). This was necessary at a time when renewables were priced higher than thermal power and they were not seen as a mature technology.

Load balancing is becoming more difficult for discoms as the share of intermittent renewables has increased rapidly in the last five years. At the same time, the discoms are being pushed by the regulators to procure more clean energy to meet the renewable purchase obligations. Thus, the discoms are now driving the next stage of auctions by having ‘demand-driven’ tender design rather than being focused on capacity.

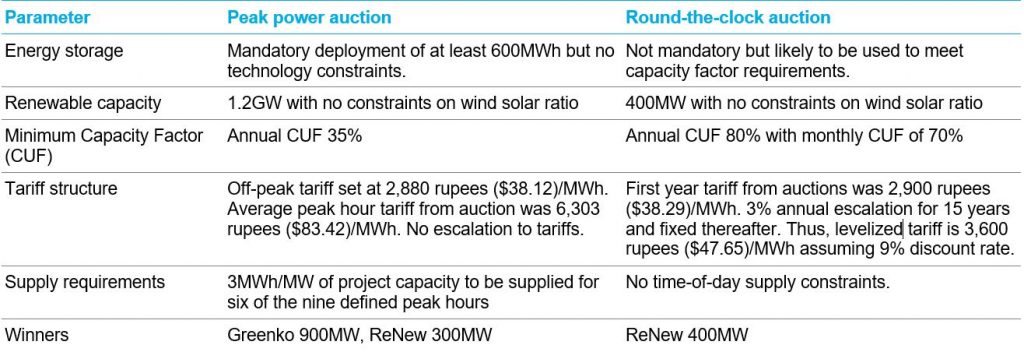

Auction designs have also evolved in India to allow co-located wind and solar projects to encourage higher use of transmission assets and reduce intermittency. In 2020, SECI issued a tender for 5GW of new renewable projects paired with existing coal power plants to supply firm power. This will reduce intermittency and at the same time revive some of the stranded coal plants. An auction was conducted in April 2020 for guaranteed peak power supply from renewables that differed from the current auction.

Source: BloombergNEF, tender documents.

Opportunity

In the next 2-3 years, we expect more such renewable projects to be auctioned. They will require high CUF, firm power or defined hours of mandatory dispatch. IPPs will need to use more sophisticated tools for granular assessment of energy production and further refine their financial strategies to manage the capex and complex penalty mechanisms. Oversized projects and use of energy storage are likely to become the norm in future auctions. It is clear that India is starting to place the responsibility of managing intermittency on the renewable IPPs as the industry has matured.

We expect federal gigawatt-scale auctions for stand-alone wind and solar to continue for some time because they help add capacity quickly and at lower tariffs. However, stand-alone state auctions may decline further as discoms have shown a preference to buy from federal entities and are inclined toward firm renewable power. Most Indian discoms are financially stressed and will continue to be price sensitive. Thus, demand for innovative tenders with higher tariffs like floating solar will remain muted until the technologies can match the tariffs of ground-mounted renewables.

India’s auctions for utility-scale wind and solar projects see large number of IPPs winning despite the industry maturing. The growth in auction volumes, long-term contracts and cost competitiveness of renewables vs coal have attracted investors. The leading IPPs want to stand out from their peers and build market niches where they have a unique advantage.

Source

BloombergNEF. Extracted from Round-the-Clock Renewables Threaten Coal Power in India published on May 13, 2020. Learn more about BloombergNEF solutions or find out how to become a BloombergNEF client.

Read next

Related actions

Ensure project bankability by mitigating offtaker risk and ensuring diverse and certain revenues streams

- Power and Grids

- Financials

- Companies