Climate-Related Financial Disclosures

Mandate companies and financial institutions to report their climate risks and impact, and integrate them into decision-making

Overview

Around the world, companies’ business models face both risks and opportunities from climate change. Yet while investors need clear data to evaluate a corporation’s commitments to managing climate risks and capitalizing on opportunities – and to allow them to factor those commitments into their portfolio management strategies – climate-related reporting has long been both spotty and inconsistent.

The Task Force on Climate-related Financial Disclosures, which was created by the Financial Stability Board (FSB) in 2015, aimed to change that. TCFD developed recommendations on how companies should report on their climate-related opportunities and risks, thereby keeping financial markets informed and making it easier for investors to recognize and manage risk.

The recommendations of the TCFD, finalized in 2017, were recognized as the standard for effective voluntary disclosure of climate-related information, having received broad support from financial institutions and organizations across the private and public sectors.

Since TCFD set the groundwork for climate-related reporting, their recommendations have been absorbed and incorporated into the International Sustainability Standards Board’s (ISSB) guidance on climate reporting.

Impact

Between 2017 and 2023, TCFD registered 4,900 corporate, financial and government supporters. Yet TCFD was never an end point in and of itself. Rather, it was always intended to be a blueprint and stepping stone to more elaborate climate reporting, which came with the publication of the International Sustainability Standards Board’s (ISSB) standards in June 2023. Due to the high amount of overlap between the two frameworks, TCFD passed the development and monitoring of firms’ climate-related disclosures to ISSB at the beginning of 2024.

ISSB’s standards include “IFRS S1”, which focuses on general sustainability disclosures, and “IFRS S2”, which has a specific focus on climate disclosures. Companies can continue using the TCFD’s recommendations as they move towards the more stringent ISSB standards.

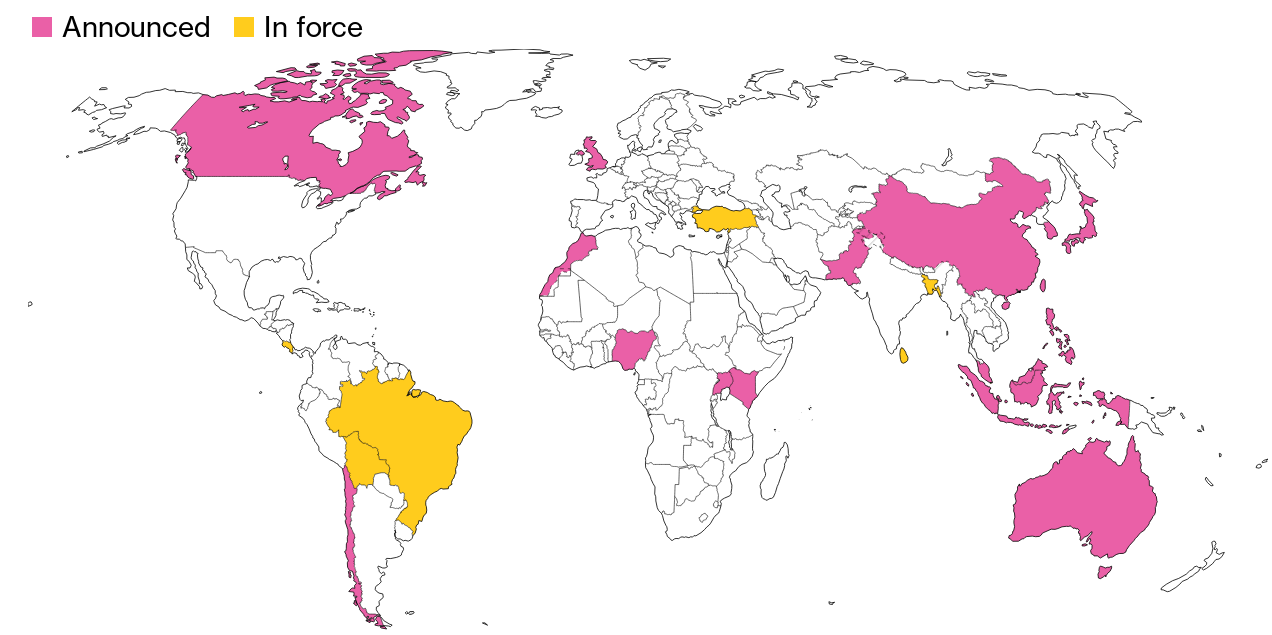

ISSB support across the globe

* Source: BloombergNEF, Responsible Investor. Note: Planned integration can be voluntary or mandatory. Data is shown for distinct economies.

Since ISSB’s standards were released in June 2023, many markets – including Canada, the EU and China – have voiced their support. Some 10 markets, including Brazil, Japan and the UK, have taken this support a step further and indicated their intention to build the ISSB standards into local sustainability reporting legislation. While there has been no federal support for ISSB in the US, at the state level California’s new climate legislation requires certain companies to report climate risk utilizing TCFD and ISSB standards.

As these markets work to integrate ISSB principles into their localized climate frameworks, reporting will likely become mandatory. Brazil and Turkey have been first movers on this front. The Brazilian Ministry of Finance announced ISSB standards will be integrated into Brazilian regulatory frameworks in 2024, with mandatory disclosure required by 2026.

Opportunity

The TCFD framework is considered central to improving the quality of the climate disclosure landscape by raising awareness and building widespread support. The newer ISSB aims to further improve and simplify transparency around companies’ sustainability performance .

However, if governments choose to follow the broad adoption of ISSB without going into specific metric reporting, the rule will not be as impactful as intended. For instance, firms could use different units in their reports, or assess different metrics, making it difficult for investors and banks to standardize the reporting and build systematic assessment models.

Following the TCFD’s success, the Taskforce on Nature-related Financial Disclosures, or TFND, released its completed framework in September 2023 for organizations to report their risks and opportunities related to nature. Supported by 1,500 businesses, non-governmental organizations and research groups, the 40 members represent companies with over $20 trillion of assets, while over 400 organizations have committed to report their nature-related impacts. This push for alignment reflects industry acknowledgment of the risks and opportunities inherent in businesses’ interaction with nature.

The revised disclosure landscape – both mandated and voluntary – is enabling financial institutions to better evaluate the climate- and nature-related risks associated with their investments. This will likely foster accelerated action. However, while improving the volume of disclosures through ISSB and now TNFD is crucial for improved awareness and progress, it is not a foolproof solution for lowering the environmental impact of the financial sector. Legally binding regulation, mandatory reporting and enforcement are crucial to hold financial institutions accountable for their climate impact.

Source

BloombergNEF, TCFD, TNFD, ISSB, FSB, Responsible Investor

Read next

Related actions

Mandate companies and financial institutions to report their climate risks and impact, and integrate them into decision-making

- Power and Grids

- Industry and Materials

- Transport

- Buildings

- Agriculture

- Financials

- Companies