Green Taxonomies: European Union

Mandate companies and financial institutions to report their climate risks and impact, and integrate them into decision-making

Overview

Climate-related financial disclosures play a key role in driving decarbonization. Yet before companies can disclose this activity, they need to know what counts as an ‘environmentally sustainable’, and they need clear rules around transparency and reporting.

The European Union set up the world’s first mandatory reporting framework for companies and financial institutions to disclose the environmental impact of their economic activities. By offering clear definitions for environmental sustainability, this framework, known as the EU Taxonomy, stands to help investors and banks assess the ambition of companies’ decarbonization plans, and thus encourages corporations to set more demanding climate goals.

Impact

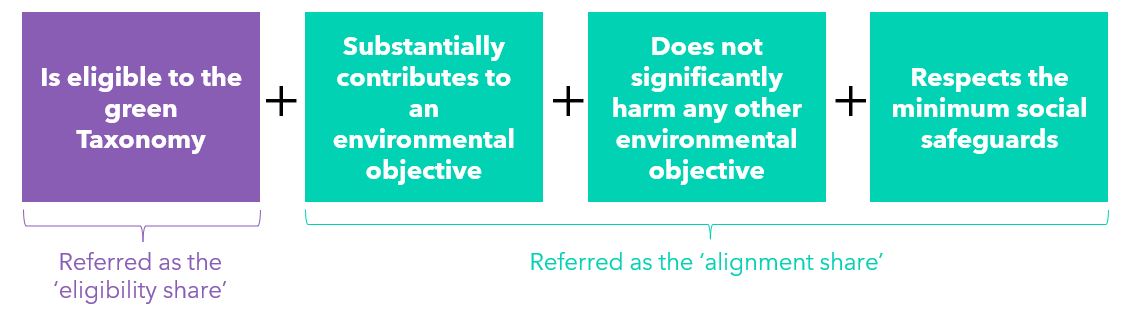

Beyond serving as a reporting framework, the Taxonomy is also a regulation that compels financial and non-financial organizations in the EU to report their alignment with the classification. This follows a four-step methodology.

First, corporations must establish their reporting eligibility. In other words, do their economic activities (categorized by revenue, capital expenditure and operating expenditure) hold the potential to become ‘green’ according to the Taxonomy’s standards?

Second, these corporations determine whether their eligible activities are aligned with at least one of the Taxonomy’s six objectives:

- Climate change mitigation

- Climate change adaptation

- Sustainable use and protection of water and marine resources

- Transition to a circular economy

- Pollution prevention and control

- Protection and restoration of biodiversity and ecosystems

The company must prove that the economic activity “substantially contributes” to an objective. For example, an activity contributes significantly to climate change mitigation if it has a demonstrated impact on lowering greenhouse gas emissions.

Third, the economic activity must not cause any harm to the Taxonomy’s other objectives. If the activity mitigates greenhouse gas emissions but decreases the restoration of biodiversity, then it would not qualify as aligned with the Taxonomy.

Finally, the economic activity must respect a set of minimum social safeguards. This means that aligned activities cannot qualify if they violate human rights, engage in bribery, be noncompliant with taxation practices or distort fair competition.

EU taxonomy four-step methodology

The stringent requirements of the EU taxonomy mean alignment is currently quite low. With only 8.7% of revenue aligned with the framework on average among reporting companies in 2023, the exercise reveals that very few organizations can claim to be ‘green’.

However, Taxonomy reporting still allows investors to assess which companies need more financing to fund their transition, and which firms are already walking the walk and investing in their decarbonization journey. This presents investors with standardized, decision-useful data and a big opportunity to spearhead decarbonization in more fruitful sectors.

Opportunity

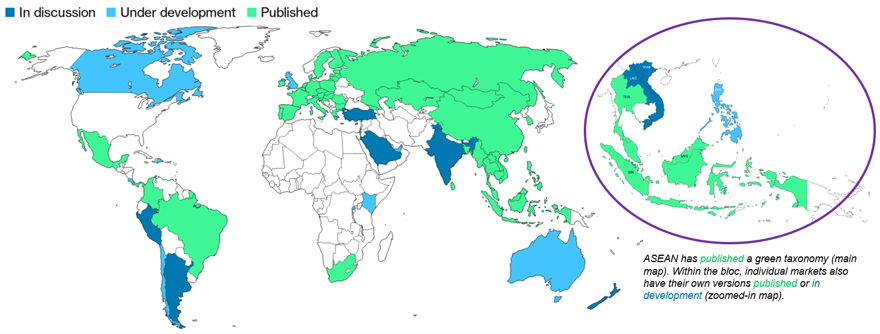

While the EU pioneered the use of a green taxonomy, other markets have followed suit. As of October 2024, some 21 green or sustainable finance taxonomies have been published across the globe with an additional 20 either under development or announced by regulators globally.

Green taxonomies across the globe

* Source: BloombergNEF. Note: Brazil is marked as ‘published’ as the industry-led taxonomy is already in place, although the government-led taxonomy is currently under development. ASEAN = Association of Southeast Asian Nations. Mapped data are for distinct economies.

Brazil’s government launched a working group in 2024 to develop a country-wide sustainable finance taxonomy that will cover both environmental and social objectives. While initially voluntary, reporting within the taxonomy will become mandatory from 2026, making it only the second green classification system that requires disclosure after the EU. All institutions, ranging from corporations and insurers to asset owners and banks, will be able to use the taxonomy in its initial voluntary form.

Brazil’s taxonomy will follow the same assessment structure as the EU. Environmentally sustainable economic activities will have to prove a substantial contribution to an environmental objective through a set of technical screening criteria, prove that they do not harm any environmental objective and respect a set of minimum social safeguards. Yet it will go a step further than the EU, following Mexico in covering social objectives in addition to environmental ones.

While taxonomies do not enforce sustainability measures among companies, simply requiring public disclosure of this information is valuable to consumers and financial institutions.

Taxonomy-required company disclosures demonstrate how well economies and financial markets are aligning with the Paris Agreement, provide clarity on the relative sustainability of each sector, and help the financial industry target sectors with the lowest levels of eligibility and alignment. They can also assist regulators and policymakers in identifying sectors that need more support to decarbonize, and design incentives that can enable the financial industry to prioritize the needs of these sectors.

Source

BloombergNEF, European Union

Read next

Related actions

Mandate companies and financial institutions to report their climate risks and impact, and integrate them into decision-making

- Power and Grids

- Industry and Materials

- Transport

- Buildings

- Agriculture

- Financials

- Companies