Mitigating Environmental Risk in Finance: Climate Stress Testing

Financial stress testing refers to running hypothetical scenarios to determine how well a financial institution can handle a potential economic shock or crisis.

Overview

Financial stress testing refers to running hypothetical scenarios to determine how well a financial institution can handle a potential economic shock or crisis. Stress tests can be done at a macroeconomic level, where central banks assess the impact of economic scenarios on a whole economy, or using a bottom-up approach, where financial institutions are compelled to assess their profit and losses under various market conditions.

Central banks may require individual institutions to conduct their own stress testing, which raises awareness and encourages strategy development among financial entities. A stress test could include, for example, modeling the effects of increased interest rates on the ability of small banks to meet the capital requirements of their depositors.

Banks may not want to participate in stress testing because of the additional costs for them to conduct their own tests if mandated by the government, and the potential for their weaknesses to be exposed publicly, attracting further scrutiny. The higher mandated capital reserves could also decrease short-term profits.

Following the 2008 financial crisis, Congress passed the Dodd-Frank Act in the US, which locked in oversight from the Federal Reserve on the financial sector by requiring stress testing and additional regulations. However, with the new rules came accelerated lobbying efforts from the sector to reduce its compliance obligations. These campaigns proved to be successful, with the

Greg Becker, the former chief executive office of Silicon Valley Bank (SVB), was among those who lobbied Congress to increase the asset cap from $50 billion to $250 billion. SVB held over $200 billion in assets, so the higher cap allowed the bank to ignore its weaknesses, invest for short-term profits via buying bonds at the then-low interest rates, and maintain low capital reserves with no questions asked. The collapse of SVB, alongside Signature Bank, First Republic, and Credit Suisse, reveals how imperative such regulation and testing is to economic security. Since the collapse of these banks, the Fed has continued to hike interest rates, putting even more small banks in jeopardy of failing to provide for their customers.

Impact

Climate stress testing refers specifically to an exercise by a government’s central bank to assess the resilience of a financial system to risks arising from climate change. Long-term climate scenarios, such as the pathways from the UN Intergovernmental Panel on Climate Change, are used to model potential economic outcomes over multidecadal time horizons. This kind of testing helps raise awareness about climate-related risks and, as a result, encourages financial institutions to hedge against these risks.

Climate risk includes two subcategories: physical risk, which refers directly to the environmental changes associated with climate change, and transition risk, which refers to the economic costs from adjusting to a low-carbon economy. An example of a transition risk would be the potential losses associated with a stranded asset resulting from shutting down a coal plant before the end of its useful lifetime. A physical risk would be the economic losses from natural disasters like floods or wildfires.

Material financial climate risks can manifest in the form of credit risk, default risk, collateral depreciation, and exposure to companies or industries left behind in the energy transition. Like traditional stress testing, revealing climate vulnerabilities could lead regulators to require higher capital reserves when banks are lending to fossil-fuel companies, who face a greater stranded-asset risk. When introducing requirements for climate stress tests, policymakers should consider how to minimize costs for financial institutions to conduct these tests.

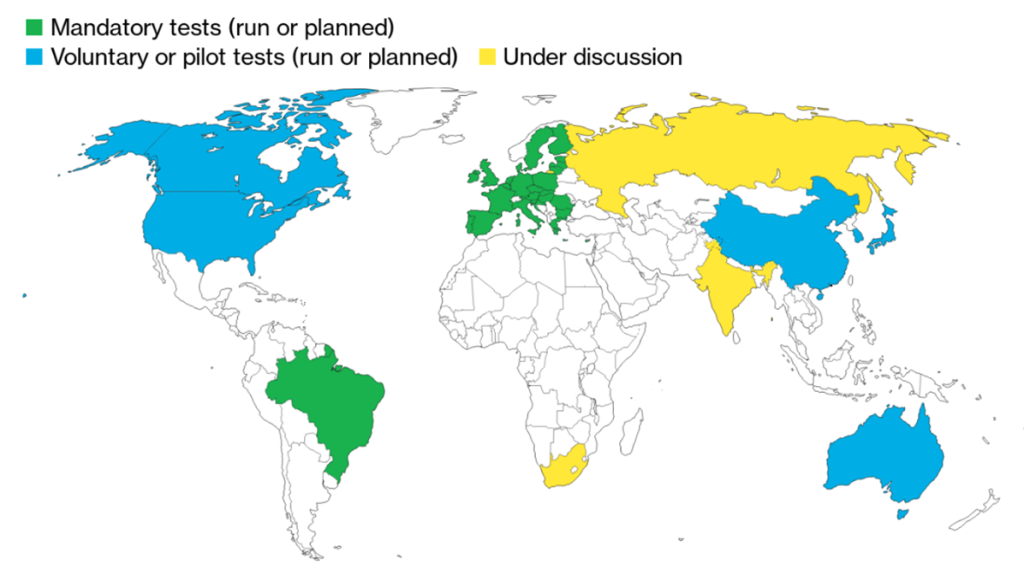

So far, regulators have rolled out climate stress tests in a loose way. Most are voluntary or have been introduced only within pilot groups of financial institutions, and none impact capital requirements yet. Additionally, not all climate risk stress tests follow the same methodology. Regulators have either integrated climate risks into existing stress tests or tackled them through separate exercises. For instance, the Brazil’s central bank decided to integrate climate factors into its conventional stress test, while the European Central Bank and Bank of England have run separate exercises dedicated to climate-risk scenarios, alongside their other non-climate stress tests.

Status of climate-risk stress tests in G-20 markets

Source: BloombergNEF

Opportunity

The recent collapse of several banks again reveals that many economic risks are underestimated, despite being well known. For lesser-understood risks, like climate, it is essential for financial institutions and regulators to develop effective disclosure frameworksto close the information gap. Mandatory and voluntary disclosure schemes, like the EU taxonomy and Task Force on Climate-related Financial Disclosures, help bridge the information gap and encourage companies to disclose their emissions data, which makes it easier for financial institutions to implement climate stress testing. While 13 markets have discussed, planned, or implemented climate stress testing, there is still a long way to go before it becomes the status quo in finance regulation.

Read next

Related actions

Mandate companies and financial institutions to report their climate risks and impact, and integrate them into decision-making

- Power and Grids

- Industry and Materials

- Transport

- Buildings

- Agriculture

- Financials

- Companies