Targeted Subsidies for Emerging Technologies: North America

Support carbon capture, utilization and storage projects and infrastructure and other carbon removal technologies, Support low-carbon hydrogen production close to demand

Overview

Targeted subsidies are often needed to give new technologies a push when the economics don’t work out right away. Subsidies can enable a technology to mature and eventually compete in the market. For example, carbon capture and storage, better known as CCS, has advanced as a technology, but in most regions and applications, it is still too small and expensive to scale without policy support. As a result, deployment is still muted.

In BloombergNEF’s Net Zero Scenario, which lays out a pathway to achieve net-zero emissions by mid-century, the total emissions abatement needed from CCS by 2050 is 5,081 million metric tons of CO2 globally. Yet, current capacity is only about 244 million tons per year.

The most straightforward way to encourage CCS projects is through direct subsidies, of which two different models are available in the US and Canada to accelerate deployment. Canada has chosen one-off capital expenditure grants to spur its industry, while the US has implemented recurring operating expenditure payments under the Inflation Reduction Act.

The Canadian tax credit covers 50% of equipment costs for point-source capture, 60% for direct air capture and 37.5% for transport, storage and utilization over 2022-2030. After 2030, the subsidy rates will halve. The US Inflation Reduction Act, meanwhile, increased the 45Q tax credit to $85 per ton of CO2 stored and $60/tCO2 utilized. The 45Q is a production tax credit and incentivizes each ton of CO2 captured or utilized, so the value of the credit is not dependent on the project’s capex.

Impact

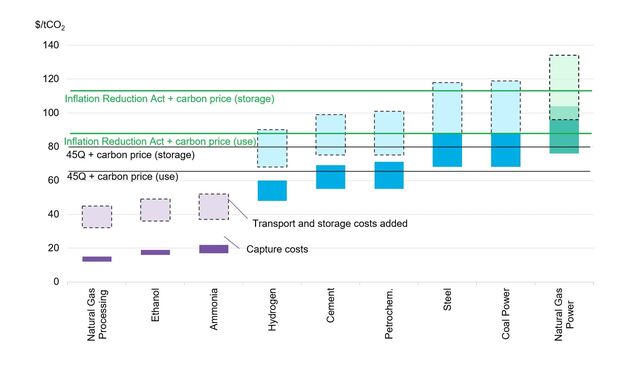

Subsidy-driven cost reductions for CCS among industrial sources are nuanced, reflecting the varying cost of capture between high- and low-concentration sources. The US approach of recurring payments is already promoting new project development. At the level the tax credit is set at, the 45Q uplift in the US makes CCS viable for most industries, allowing “blue” hydrogen (produced using fossil fuels and the emissions captured), cement, petrochemicals and even steel plants to offset a large portion of their operational costs via the subsidy. Both high-concentration and industrial applications could recover most, if not all, of their costs through the 45Q production tax credit.

Direct air capture receives an even higher subsidy in the US of $180/tCO2 stored and $130/tCO2 utilized, reflecting the far higher capture costs. The credit provides easy, accessible, uncapped revenue certainty for the first 12 years of a CCS project. Due to this, BNEF expects CCS and direct air capture project announcements to increase exponentially over the next decade. The subsidy has even garnered international interest, with companies entering the US market.

Nth-of-a-kind carbon capture cost with the US Inflation Reduction Act credit

* Source: Great Plains Institute, BloombergNEF. Note: The green lines refer to the new credit levels, while the black lines refer to the original levels.

* Source: Great Plains Institute, BloombergNEF. Note: The green lines refer to the new credit levels, while the black lines refer to the original levels.

Canada’s capex-based subsidy is less generous, meaning capture costs will remain high and the tax credit alone will not be enough to make the business case for CCS for most emitters. High-concentration sources, like ethanol, natural gas processing and ammonia, may realize 10-15% cost reductions, translating to $2-4/tCO2. These sources will benefit from the tax credits the least, as they are the most mature applications with relatively low capital expenses. Overall, the tax credit may lower capture costs for industrial sources like cement, steel, petrochemicals and coal by 25-35%, and direct air capture costs by up to 35%. The Canadian government hopes that pairing the credit with the carbon price, which is expected to reach $75tCO2 by 2025 and $130/tCO2 by 2030, will spur demand, as the credit would make it cheaper to build CCS than to pay the carbon price.

Opportunity

Governments use subsidies to encourage behaviors when there is a clear societal need or interest in a service or good that the free market cannot provide, like agricultural subsidies to farmers. Targeted subsidies help drive the innovation and deployment of emerging technologies, allowing them to eventually become profitable and competitive without government support. In this case, governments have an interest in subsidizing CCS because of national targets to decarbonize and the likely reality that transitioning to renewable sources will not be enough to phase out all carbon emissions.

Countries considering CCS subsidies should weigh both opex or capex credit designs and decide which is more feasible and appropriate for their needs. Governments can compare the unique capex and opex costs for producers in their countries, the dominant industries requiring CCS, and existing subsidies that could influence the costs.

There is risk involved when creating a targeted subsidy, such as the technology never taking off or no longer being needed. It is therefore important for governments to consider their budget and other limiting factors before subsidizing such technologies. Lastly, subsidies can also distort trade flows or encourage producers to move operations, which could result in unforeseen geopolitical or economic consequences.

Read next

Related actions

Support carbon capture, utilization and storage projects and infrastructure and other carbon removal technologies

- Power and Grids

- Industry and Materials

- Companies

- Financials

Support low-carbon hydrogen production close to demand

- Power and Grids

- Industry and Materials

- Companies

- Financials